The global fleet management market, valued at approximately $68 billion in 2025, is no longer just about vehicle tracking. It has evolved into a sophisticated ecosystem that leverages telematics, artificial intelligence (AI), and big data to optimize safety, efficiency, and regulatory compliance. Driven by stringent regulations such as the EU’s General Safety Regulation (GSR), rising operational costs, and an increasingly compelling business case for risk reduction, the industry is undergoing a profound technological transformation.

This report analyzes the market from 2024 to 2030 and highlights a projected compound annual growth rate (CAGR) of 10–14%, with significant regional variations. Key takeaways for business leaders include the critical need to integrate AI-powered video safety systems, the strategic importance of choosing open and scalable system architectures, and the growing value of data as a core strategic asset for competitive advantage.

Introduction: The Evolution from Tracking to Intelligent Operations

Historically, fleet management was synonymous with basic vehicle tracking. Today, it represents a comprehensive, data-driven approach to managing a critical business asset—the mobile fleet. Modern systems act as the central nervous system for logistics, transportation, and service companies, providing real-time insights into vehicle location, driver behavior, fuel consumption, maintenance needs, and, most importantly, safety and compliance.

Market growth is fueled by a convergence of factors: post-pandemic pressure to control total cost of ownership (TCO), a global regulatory push for safer roads, and technological advancements that make sophisticated capabilities more accessible and cost-effective. For CEOs, operations directors, and financial officers, investing in a modern fleet management system is no longer merely an optional efficiency tool; it is a core strategic imperative for resilience and growth.

Market Size, Growth, and Core Drivers

The global fleet management market is on a robust growth trajectory, expected to expand at a CAGR of 10–14% through 2030. This growth is uneven across regions but is propelled globally by several powerful, interconnected drivers.

- Regulatory Compliance as a Business Driver: Regulations have shifted from being a compliance burden to a primary business driver. In Europe, the EU’s GSR mandates advanced safety features such as Blind Spot Information Systems (BSIS) and Driver Monitoring Systems (DMS) for new commercial vehicles. In the United States, the Federal Motor Carrier Safety Administration (FMCSA) mandates Electronic Logging Devices (ELDs). Non-compliance is no longer a viable option, making integrated safety technology a prerequisite for market participation.

- The Imperative for Safety and Liability Management: The high cost of accidents—including insurance premiums, vehicle downtime, legal fees, and reputational damage—is a major pain point. AI-powered video telematics (dashcams, DMS) provide irrefutable evidence to exonerate drivers and companies from false claims, while also proactively coaching drivers to prevent incidents. This directly and measurably impacts the bottom line.

- Operational Efficiency and TCO Reduction: In an era of fluctuating fuel prices and tightening margins, optimizing routes, reducing idle time, and enabling proactive maintenance are critical. Modern fleet management platforms provide the data and tools needed to reduce fuel consumption, extend vehicle lifespan, and improve asset utilization across the fleet.

- Data-Driven Insurance and Risk Modeling: Insurers are increasingly offering preferential premiums to fleets that deploy certified safety technologies. Data generated by telematics and video systems enables risk-based pricing, rewarding safe fleets with significant cost savings and creating a clear return on investment (ROI) for technology adoption.

Regional Market Breakdown: A Tale of Diverse Landscapes

The global market is characterized by distinct regional dynamics, requiring tailored go-to-market strategies.

- North America (Market Value: ~US$24B): The most mature region, characterized by high adoption rates. Growth is driven by strong regulatory enforcement (e.g., FMCSA rules), a focus on insurance telematics, and the need for efficiency in large, complex logistics networks. North America is also a leader in deploying advanced analytics and AI-driven solutions.

- Europe (Market Value: ~US$18B): The regulatory catalyst. The EU’s GSR is the single biggest driver, accelerating the adoption of AI safety systems. Local regulations and standards such as London’s Direct Vision Standard (DVS) further stimulate demand, creating a strong aftermarket for retrofitting existing vehicles with safety technology.

- Asia-Pacific (Market Value: ~US$16B): The high-growth engine. This region shows the highest CAGR, driven by rapid modernization of logistics infrastructure in China and India, the expansion of e-commerce, and growing awareness of fleet safety and efficiency. The market is highly price-sensitive but offers immense scale for vendors with flexible product and pricing strategies.

- Latin America and Middle East & Africa (MEA): These regions represent significant growth potential, with projected CAGRs of ~14.1% in Latin America and ~11.9% in MEA. Key drivers include high accident rates prompting government action, the need to combat fuel theft and cargo losses, and ongoing modernization of public transport and logistics fleets.

The Technological Core: Video Telematics and System Architecture

The most significant technological trend is the integration of video telematics into the core fleet management stack. This evolution moves fleets beyond simple GPS tracking toward a multi-layered, intelligent architecture:

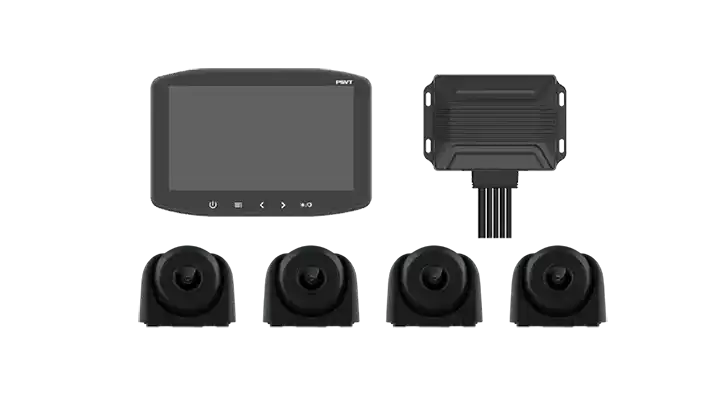

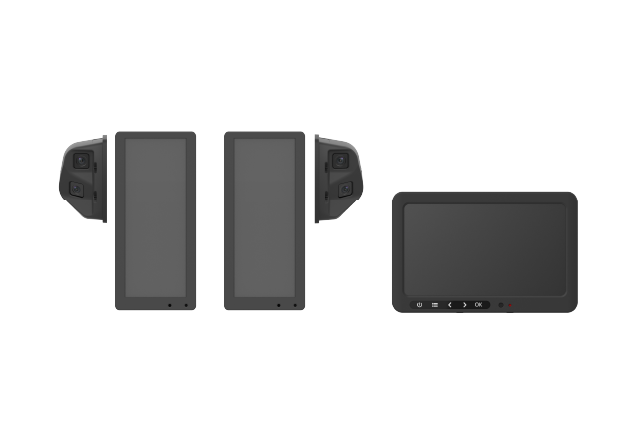

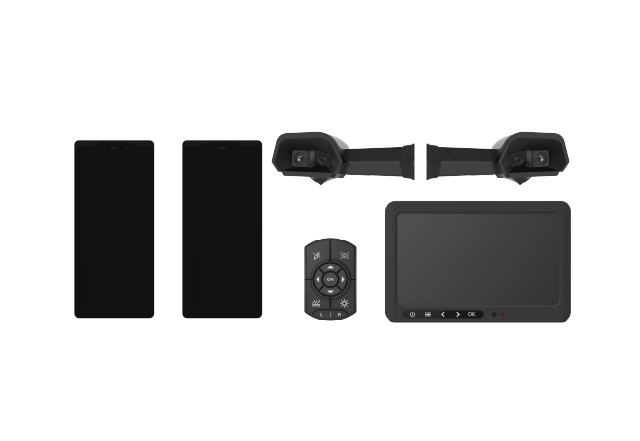

- Front-End Perception: AI dashcams, DMS, and mobile digital video recorders (MDVRs) act as intelligent sensors, capturing video and analyzing driver behavior and road scenes in real time.

- Edge Processing: Data is processed inside the vehicle using specialized hardware, reducing bandwidth requirements by transmitting only critical event data and relevant video clips to the cloud.

- Cloud Platform & Analytics: The cloud platform functions as the command center, aggregating and analyzing data and presenting it via dashboards. It enables real-time alerts, historical reporting, driver scoring, and compliance management at scale.

For technical buyers, the key is to select systems built on open standards and APIs (e.g., MQTT, RESTful APIs) that allow seamless integration with existing telematics, transport management (TMS), and fleet management systems (FMS), rather than creating new data silos.

Future Trends (2024–2030): The Strategic Horizon

The fleet management landscape will be shaped by several structural trends over the coming decade:

- AI Maturation and Sensor Fusion: AI models will become more sophisticated, reducing false alerts and providing deeper insights into driver behavior and risk patterns. The fusion of camera data with radar and other sensors will create more robust perception systems, enabling enhanced ADAS capabilities and safer operations.

- Shift to Platform-Based and Open Ecosystems: Value will increasingly shift from standalone hardware to open, software-centric platforms. Fleets will prioritize solutions that allow them to mix and match best-in-class hardware (cameras, sensors) with software applications for safety, maintenance, dispatching, and business analytics.

- Electrification and Sustainability Integration: Fleet management systems will play a central role in managing electric vehicle (EV) fleets, incorporating data on battery health, charging optimization, and range prediction. This will be essential for companies pursuing net-zero targets and low-emission logistics strategies.

- Predictive Analytics and Prescriptive Actions: Systems will evolve from simply reporting what happened to predicting what is likely to happen and recommending actions. This includes predicting mechanical failures before they occur, identifying at-risk driver behavior for targeted coaching, and dynamically optimizing routes based on real-time conditions.

Conclusion and Strategic Implications for Stakeholders

The global fleet management market is at an inflection point, driven by regulation, technology, and a compelling business case for safety and efficiency. Strategic success will depend on how each stakeholder navigates this new landscape.

- For Fleet Operators: Technology should be viewed not as a cost center but as a strategic investment. Priority should be given to scalable, open-architecture solutions that integrate video safety data into daily operations for proactive risk management and driver coaching. The ROI extends far beyond compliance, encompassing meaningful savings in insurance, fuel, maintenance, and accident-related costs.

- For Technology Providers: Success will hinge on delivering reliable, accurate, and easily integrable solutions. Clear APIs, robust SDKs, and demonstrable ROI will be critical differentiators. The market is moving away from proprietary, closed systems toward flexible, platform-based models that can evolve with customer needs.

- For Investors: The segment offers substantial growth potential, particularly in companies focused on AI-driven video telematics, data analytics, and open platform architectures that support the evolving needs of both fleet operators and vehicle manufacturers.

In conclusion, the future of fleet management is intelligent, connected, and data-driven. Organizations that embrace this transformation—leveraging data to enhance safety, efficiency, and sustainability—will be best positioned to thrive in the competitive logistics landscape of 2030 and beyond.