MDVR Demand Concentration and Where Growth Will Come From

Two fundamentals frame the MDVR market: the global stock of commercial vehicles and the still-expanding base of active fleet users that rely on MDVR for safety and claims analytics. The market is large today and getting larger, with MDVR adoption following logistics expansion, regulatory enforcement, and insurer incentives. Asia–Pacific (especially China, India, and Southeast Asia) already accounts for roughly half of global MDVR demand, with North America showing a mature, premium-leaning pattern and Europe benefitting from a structured rule framework across segments like logistics, public transit, school buses, and rentals.

From a pure installed-base perspective, the MDVR opportunity remains significant because the world’s commercial-vehicle parc counts in the hundreds of millions, leaving both retrofit and OEM paths wide open for MDVR expansion. That depth matters: each MDVR added can unlock multi-year data services, remote diagnostics, and proactive safety analytics, compounding the lifetime value of every deployment.

Regional Patterns That Shape MDVR Strategies

- APAC: The largest MDVR market by share, driven by fast-growing logistics and active infrastructure build-outs. Price bands are diverse, and MDVR designs that balance cost with AI features tend to win. MDVR projects here often scale quickly once regulatory momentum takes hold (e.g., city mandates or provincial programs).

- North America: A high-maturity MDVR market with strong insurer pull. Buyers favor advanced MDVR features (driver coaching, cloud analytics, AI events) and integration with claims workflows. School bus safety policies remain a durable tailwind for MDVR uptake.

- Europe: Harmonized rules and safety culture create steady MDVR penetration across logistics, buses, rental fleets, and specialty vehicles. MDVR vendors that align with data privacy and security expectations—while integrating with telematics and compliance portals—gain advantage.

- LATAM & Africa: Rapid growth from a low base; value-priced MDVR remains essential. Logistics digitalization, theft deterrence, and basic driver-safety features are strong wedges for MDVR entry.

What Actually Drives MDVR Adoption

Three non-negotiables move the needle for MDVR:

- Policy and regulation: When local or sector rules recognize MDVR as a compliance tool, uptake accelerates. School bus initiatives in the U.S. are a clear precedent for MDVR.

- Insurance economics: When claims frequency and severity decline due to MDVR-based evidence and coaching, the ROI becomes visible, and MDVR moves from “nice to have” to “default”.

- Logistics scale effects: Explosive growth in Southeast Asian logistics has pushed fleets to adopt MDVR to reduce incident rates, coach drivers, and streamline dispute resolution.

Quantitatively, installed bases of remote video systems in North America and Europe point to a healthy MDVR runway through the decade, with combined European/North American video systems projected to continue expanding toward the late 2020s as cloud analytics deepen. MDVR remains the practical anchor of this stack.

The Evolution of MDVR Tech: from 2G Boxes to 5G Edge AI

- Early era (2000–2008): Primitive connectivity (GPS + GPRS) and low-resolution capture defined first-gen MDVR. Storage was local only, with little to no live features. MDVR in this phase served mainly as a post-incident recorder.

- Breakthrough phase (2009–2015): As 3G proliferated, MDVR gained better video quality and multi-constellation GNSS, and added G-sensor-triggered event flags. MDVR matured from passive capture to basic alerting.

- Intelligent upgrade (2016–2020): Ubiquitous 4G enabled live HD streaming. MDVR integrated DMS (driver monitoring) and ADAS warnings, CAN-bus tapping, and OTA upgrades. Power design improved—wide input, TVS surge protection, and super-cap UPS—making MDVR more robust for commercial duty cycles.

- AI + ecosystem era (2021–present): 5G plus edge compute turned MDVR into a distributed AI node. Multi-channel analytics (face, hazardous scenarios, VRU detection) and cloud orchestration arrived. MDVR now participates in dispatch, energy tracking, and predictive safety—much more than a recorder.

Technology Trends Every MDVR Roadmap Should Reflect

AI at the Edge

Modern MDVR does first-pass inference locally to reduce bandwidth, cut latency, and keep critical alerts running even when the network drops. With DMS and ADAS fused in, MDVR can recognize fatigue, distraction, lane departure risks, and following distance violations with on-device models—escalating only the most relevant clips to the cloud. This edge-heavy MDVR approach lowers data bills while raising real-time value.

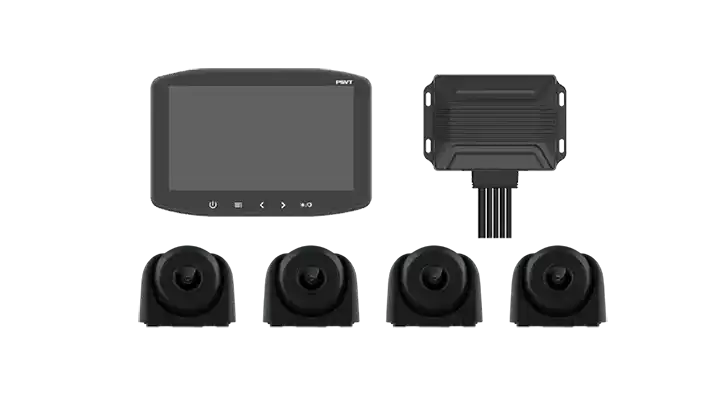

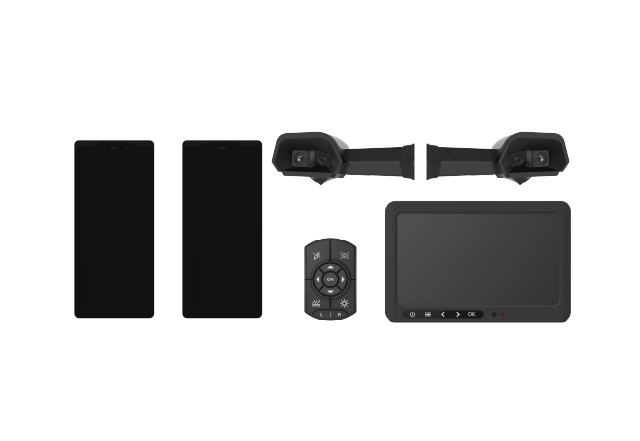

Multi-sensor Fusion

Single-camera MDVR is giving way to configurations that blend radar, 360° surround cameras, and even thermal sensors for special cargo. By fusing streams on the MDVR, detection confidence rises in rain, glare, and night conditions—and blind-spot alerts become more trustworthy. For hazardous-materials transport, heat anomalies flagged by thermal channels through the MDVR pipeline can prompt immediate intervention.

Data security and Privacy

Encryption, role-based access, and region-appropriate retention are must-haves. A compliant MDVR stance now includes end-to-end protection of video on the move and at rest, with fine-grained audit trails. In regulated regions, MDVR platforms need local storage options and policy-driven redaction workflows.

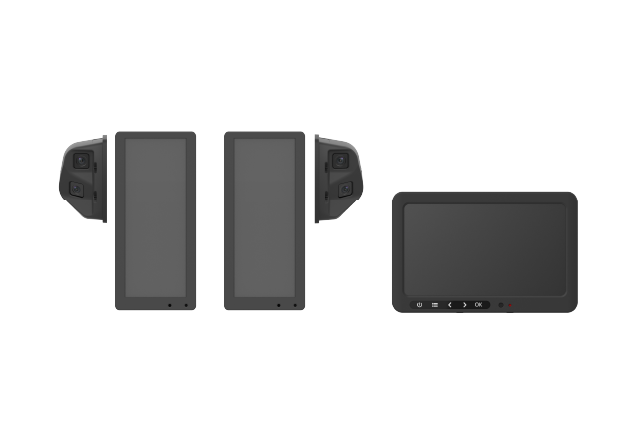

Modularity and Standard Interfaces

Standardized connectors and protocols let one MDVR SKU flex to different vehicle classes and markets. Swappable comms (4G/5G), scalable SSD/SD storage, and license-based AI packs enable fleets to start lean and grow features as returns are proven—keeping MDVR total cost of ownership predictable.

What Buyers Should Look for in an MDVR Today

1. Proven Edge Inference

A capable MDVR should run multiple AI pipelines in real time without meltdown under heat and vibration. Look for spec sheets that prove sustained multi-channel encode + inference. A solid MDVR will fall back gracefully if the network fails and persist events for later sync.

2. True Sensor Fusion

Choose MDVR that natively ingests radar, multiple cameras, CAN, and GNSS. The best MDVR designs don’t bolt sensors on later—they’re architected for fusion from day one.

3. Security by Design

Encryption on the device and in transit, secure boot, signed OTA, and robust identity management are table stakes for MDVR fleets spanning borders.

4. Open APIs + Cloud Portability

Your MDVR should not lock your data. Seek MDVR vendors offering APIs and export pathways so analytics can land in your BI systems.

5. Power and Thermal Engineering

A commercial-grade MDVR must tolerate voltage spikes, cranking brownouts, and high cabin temperatures. Super-cap UPS and TVS protection are practical tells of a well-engineered MDVR.

Why the MDVR Installed Base Will Keep Compounding

Three reinforcing loops will sustain MDVR growth:

- Data value compounder: Each additional MDVR adds route hours, context, and edge-labeled events. Your safety and maintenance models learn faster, and the MDVR becomes a lever for predictive interventions.

- Regulatory flywheel: As best practices spread, mandates tighten, and MDVR becomes a standard of care—especially in buses and high-risk freight.

- Insurance alignment: Carriers increasingly price in MDVR-supported coaching and exoneration. That improves premiums and makes MDVR rollouts self-funding.

The Roadmap to 2028: What a “Future-proof” MDVR Stack Includes

By the late 2020s, a baseline MDVR will look like this:

- 5G multi-channel encoding + inference: Your MDVR can stream when needed yet prioritize on-box detection to save bandwidth.

- Unified edge runtime: The MDVR runs DMS, ADAS, cargo-specific detection, and blind-spot logic concurrently with policy-based escalation.

- Cloud policy engine: Fleet managers push rules to each MDVR—what to record, when to upload, who sees redacted views, and how long to retain.

- Lifecycle simplicity: From install to RMA, the MDVR is a managed endpoint—serials enrolled, certificates rotated, and updates staged with minimal human touch.

- Global compliance posture: The same MDVR SKU can meet regional data rules with configurable on-device retention and geo-fenced cloud storage.

Practical Deployment Tips for MDVR Programs

- Pilot for signal, not scale: Start with representative routes and drivers. Tune MDVR event thresholds to minimize false positives before scaling.

- Close the coaching loop: MDVR is only as good as the driver feedback workflow. Pair MDVR events with short micro-lessons and track behavior change.

- Instrument ROI: Tie MDVR metrics to KPIs your CFO cares about—claims cycle time, loss ratio, downtime days avoided.

- Serviceability matters: Favor MDVR with remote diagnostics, modular harnessing, and field-swappable storage to prevent long parked repairs.

- Plan for privacy: Adopt a data-minimization policy and communicate it to drivers. A transparent MDVR policy builds trust while staying compliant.

Bottom Line

MDVR has crossed the line from “video recorder” to “edge AI terminal.” Regions like APAC will keep leading volumes, while North America and Europe anchor premium and regulatory use cases. The next phase will reward MDVR designs that fuse sensors cleanly, protect data rigorously, and deliver measurable ROI through cloud-connected analytics. If you are selecting an MDVR platform in 2025, treat it as a strategic edge node—because that is exactly what a modern MDVR has become.